Summary

The Del Norte property is one of Teuton’s original claim holdings in the Golden Triangle dating back to 1983. It is located five kilometers south of the paved road linking the town of Stewart to BC’s broader highway network. Three gold-bearing streams cut through the property–Nelson, Del Norte and Willoughby—one of them the subject of a placer operation by Cominco in the 1930’s. A definitive source for the placer gold in these streams is yet to be determined.

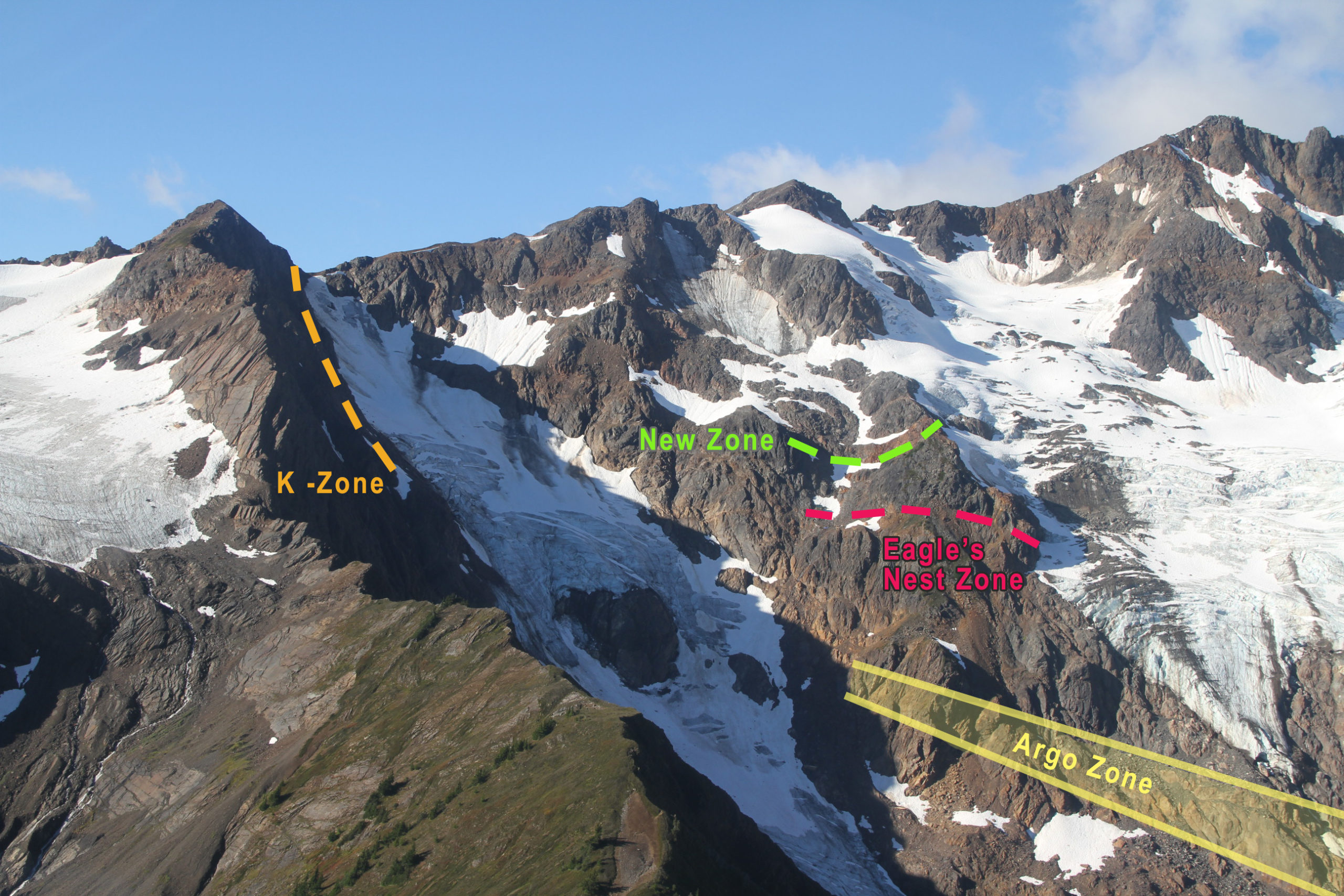

The Del Norte property was optioned to Decade Resources in January of 2020 with terms allowing Decade to earn up to a 55% interest in the property by spending $4 million over a five year period. Decade completed over 6,000 m of drilling in 23 holes to date testing three targets: the “Argo” zone (a 115 m wide north-south zone of deformation), the newly discovered Eagle’s Nest zone and the newly discovered “14 oz“ zone, the latter in the boundary area between the Del Norte and Lord Nelson properties.

Decade is currently raising money to finance the 2021 work program at Del Norte.

2020 Exploration Results

The best results of the 2020 drilling program were in the Argo zone. Both DDH DN20-18 and 20 were the deepest intersections yet in the Argo zone and as they were collared 500m from each other indicate excellent potential for establishing tonnage with continued drilling in 2021.

Highlights of drilling into the Argo zone include:

- 1049.64 g/t Ag eq over 6.03 m in DDH DN20-18, included within an interval grading 119.95 g/t Ag Eq over 58.37m

- 2128.48 g/t Ag eq over 2.46m in DDH DN20-20, included within an interval grading 221.03 g/t Ag eq over 34.09m

Ed Kruchkowski, President of the Decade Resources commented; “The newly identified Argo zone will be the focus of exploration in 2021. At the start of the past season’s program there were 2 main silver bearing trends outlined and at the conclusion of 2020 exploration, the Company had defined 6 different systems. The zones show great continuity and grades over long distances. At the start of the 2020 field season exploration, new interpretations had indicated a possible wide zone of mineralization, that was named the Argo zone. It does not outcrop and is at depth just to the west of the LG vein. The shallow 2020 holes did not intersect this zone but the deeper holes were successful in confirming the zone as well as indicating the presence of appreciable mineralization. Work in 2021 will aim at expanding the area of this deeper mineralization with much closer spaced holes as well as testing new zones.”.

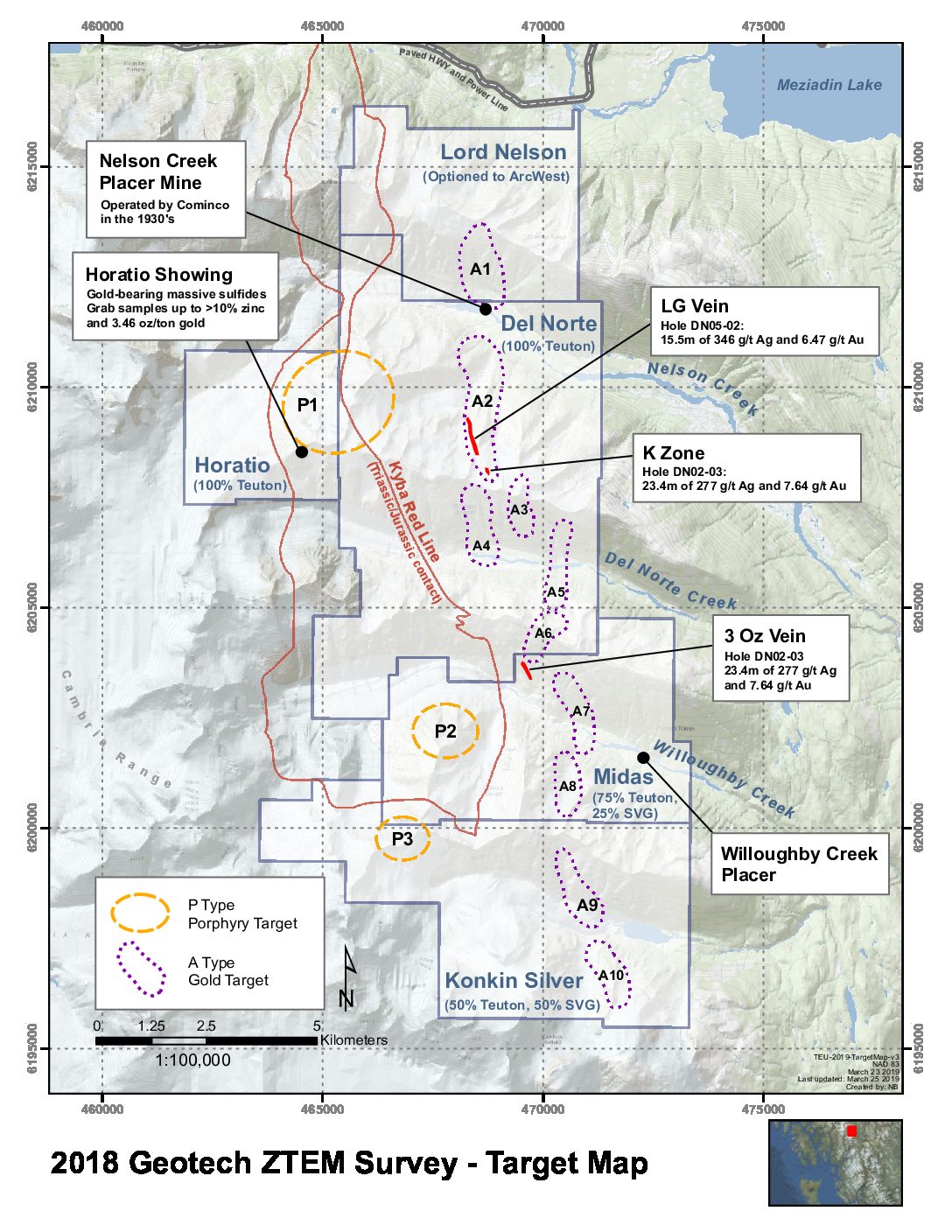

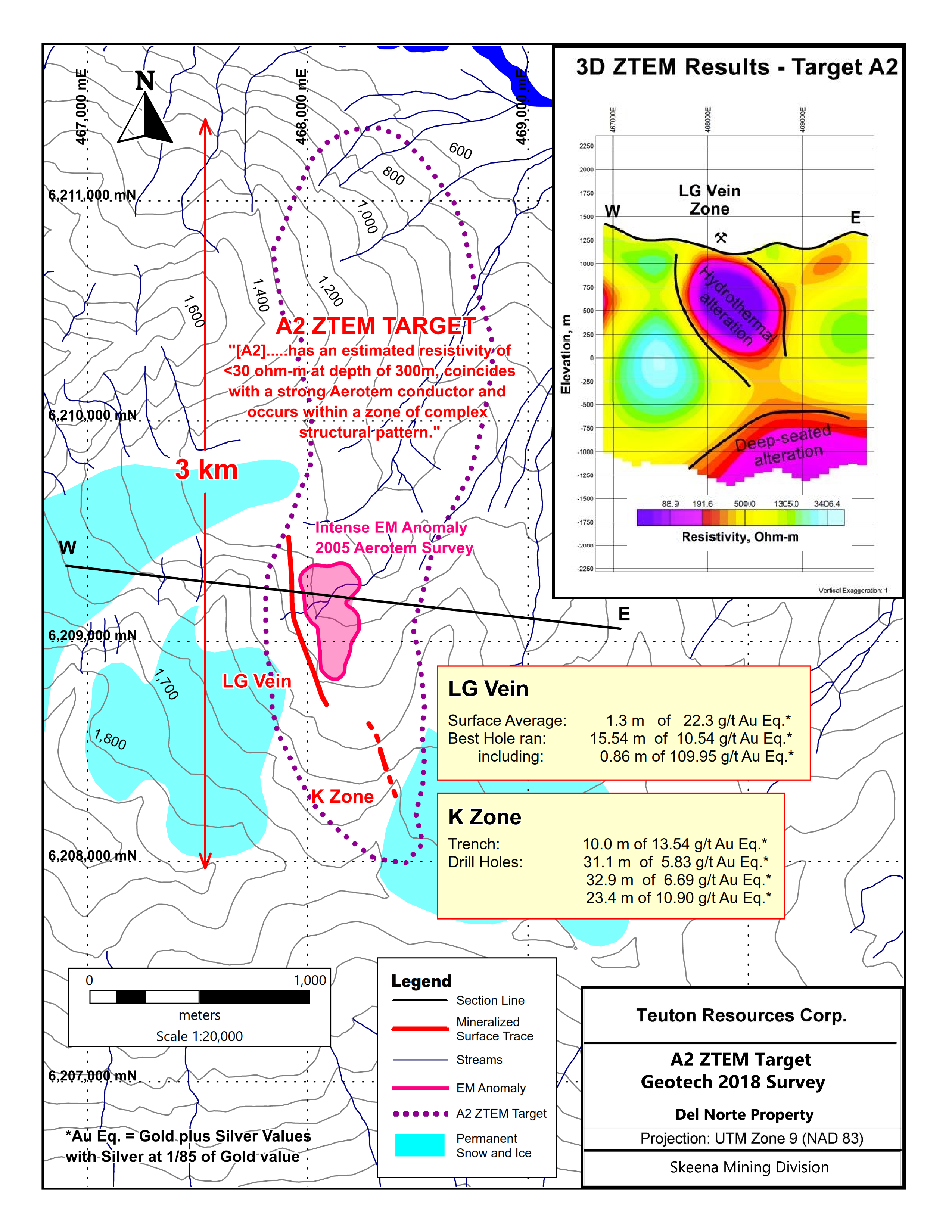

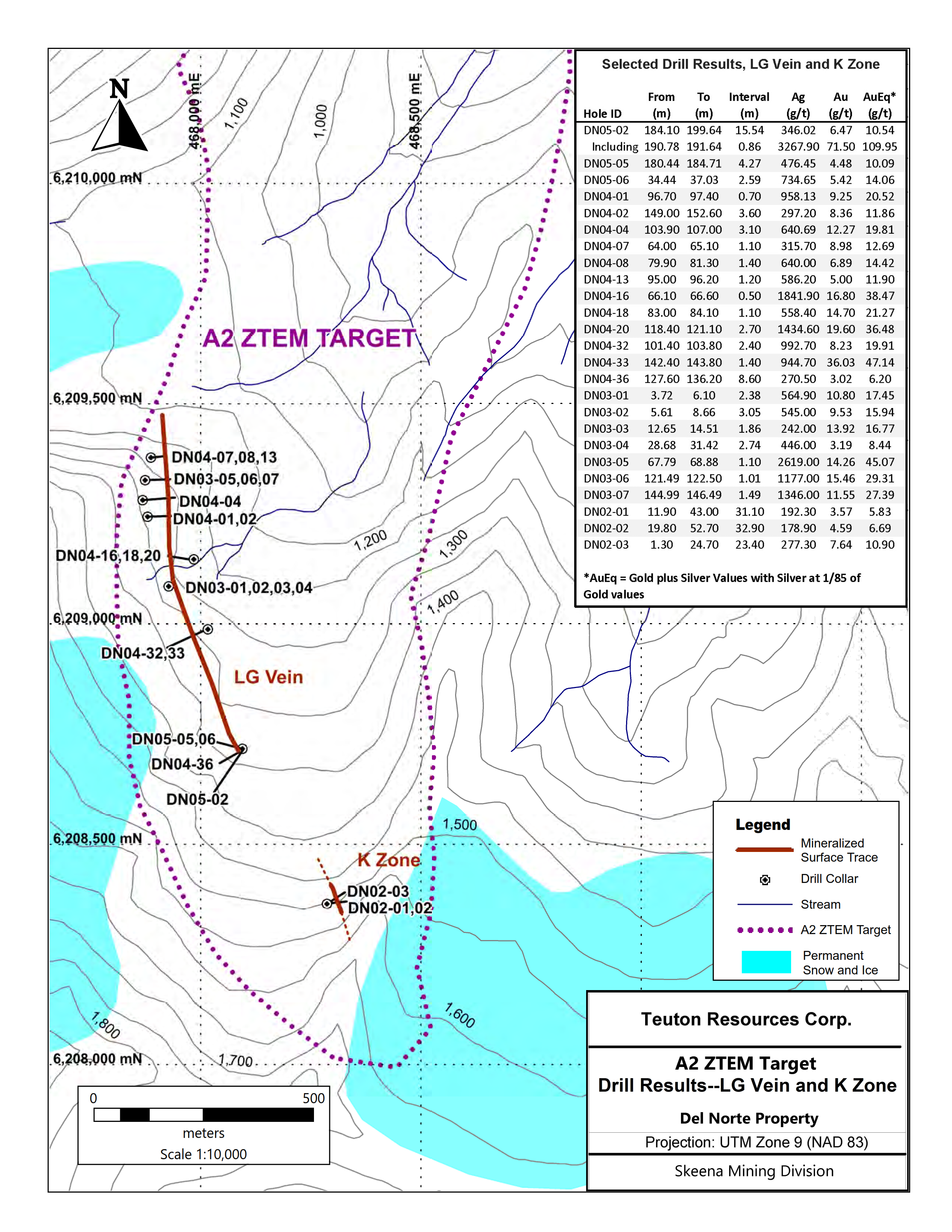

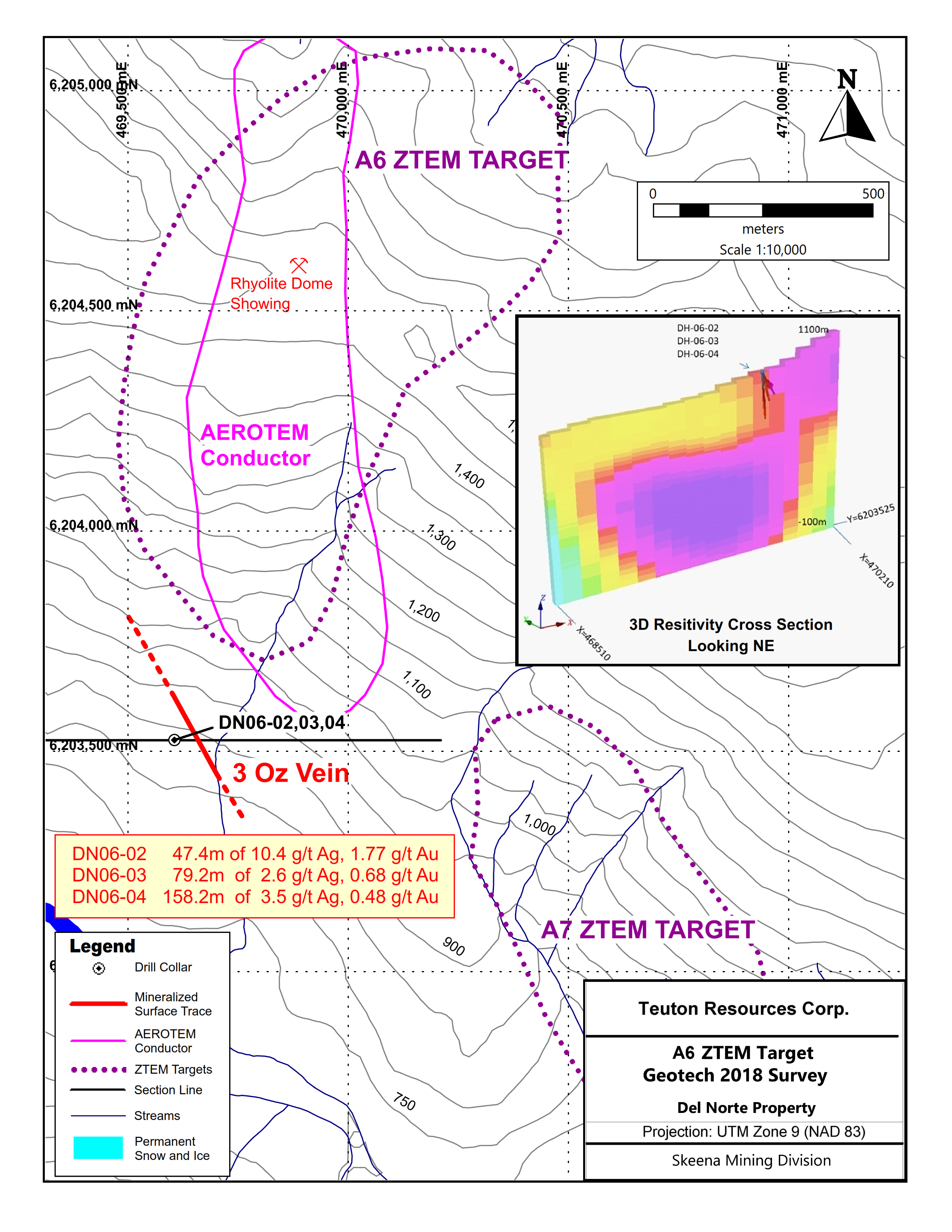

2018 Geotech ZTEM Airborne Survey

In 2018, Teuton flew a ZTEM airborne survey over the claims which resulted in the delineation of 5 gold targets (potential for mesothermal gold mineralization) and 1 porphyry target. One of the gold targets coincides with the LG vein which was drilled between 2003 and 2006 and the K zone which was drilled in 2002. The ZTEM survey indicates the favourable horizon for finding gold mineralization extends the length of the property and is much more extensive than indicated by either the LG vein or K zone occurrences. It also suggests that the hydrothermal activity to which both of these structures is related goes deep, to at least 1,000m. In addition, it shows that the center of the low resistivity anomaly which marks the “A2” target coincides with an intense EM anomaly discovered during a 2005 Aerotem survey. This target was drilled by Teuton in 2019. Although economic grades were not discovered, geological indications are that a VMS system may lie nearby. [In regard to the latter point, a narrow intersection of massive sulfides was obtained in 2021 (see picture of very fine-grained sphalerite).]

The ZTEM survey also discovered a large porphyry target, the “P1” lying close to the western boundary and overlapping Teuton’s 100%-owned Horatio property. This porphyry target lies to the northwest of the Crackle zone (discovered in the 1990’s) and a drillsite in 2016 which returned porphyry copper-gold mineralization. The Crackle zone has not been drilled but is at the center of prominent copper soil anomaly. The deepest 2016 drill hole returned an intersection running 74.2m of 0.15% Cu and 0.27 g/t Au within a zone featuring K-spar alteration, interpreted to be in the periphery of a porphyry system.